Virginia Transportation Funding Bill HB2313

Transportation problems in Northern Virginia are addressed in HB2313. Some of it is disappointing. But as much as we hate increased taxes designated for Northern Virginia, the lack of any comprehensive transportation reform since 1986 makes the 2013 Virginia Transportation Funding Bill a better-than-nothing scenario. Although this bill represents progress for a transportation network in Northern Virginia which by all objective measures is a complete failure, it ignores commuter rail upgrades along I-95 & I-66 corridors. Northern Virginia will receive funding from this transportation bill. But citizens will pay more than their share for new construction projects.

Virginia Transportation Funding Bill HB2313 is loaded with new taxes, including regional taxes for Northern Virginia to be spent for local projects as determined by the Northern Virginia Transportation Authority. The NVTA board has members from the Counties of Arlington, Fairfax County, Loudoun County, & Prince William. Along with the Cities of Alexandria, Falls Church, Fairfax, Manassas, & Manassas Park. So residents of Stafford and Fauquier Counties escape paying the special assessments of this bill. Voting on future projects is weighted on the population of each jurisdiction. Northern Virginia regional taxes are bit of a sore subject for its citizens. Tax collections from our region routinely come back to its citizens at a rate of .30-.33 cents of each dollar sent to Richmond. Northern Virginia special assessments are distributed among Virginia Planning District 8.

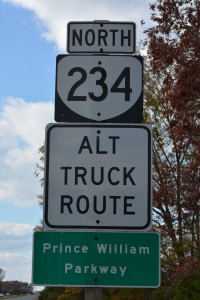

The Bi-County Parkway would connect Dumfries Road (Route 234) and Interstate 95 Manassas exit 152 to Dulles Airport and the Loudoun County Parkway. This route would terminate at Harry Byrd Highway (Route 7) and become an alternative to the bumper-to-bumper rush hours on Centreville Road (Route 28) and Lee Highway (Route 29).

The Prince William County Parkway from Manassas to Gainesville is designated as an alternate truck route. Its current use justifies connecting it to Dulles Airport and Loudoun County.

Revenue Created by HB2313 creates $3.5B for Virginia highways and rails during the next 5 years, and $880M annually after the initial 5 years. The bill creates $300-$350M for Northern Virginia transportation projects, and 30% of total revenues after the first 5 years. The calculated revenues of new taxes created by HB2313 follows:

(1) The increase in state taxes will add $1.5B during the next 5 years.

(2) Higher titling taxes on vehicles will add $1.2 B for 5 years.

(3) This bill immediately moves 200M from Virginia’s General Fund to transportation projects.

(4) HB2313 finances Phase II of the Metro Silver Line extension to Dulles International Airport by providing 300M from general funds. This project was created to make Dulles Airport more competitive with Reagan National Airport, and Baltimore-Washington International. HB2313 funding extends the line through Reston and Herndon to Dulles Airport and Route 772 in Loudoun County while adding 7 stations. Click here for updates and information about the Dulles Silver Line.

(5) This bill raises $300M-$350M each year by keeping an existing 2.1% in local fuel taxes. (6) HB2313 increases the percentage of the general fund for transportation from 0.5% to 0.675%. Funding the Future of Virginia Transportation According to the VTRANS2035 Report investment priorities in Northern Virginia include high speed rail (intercity rail) between Washington, D.C., Richmond, & Hampton Roads. Metrorail expansion is mentioned in ambiguous terms. There is also mention of connecting high speed rail with regional transit systems. The report includes billions in transportation development and maintenance costs, future growth patterns, funding alternatives, and transportation priorities. With so much talk about rail transportation in this long range report, it was surprising to see commuter rail improvements were not a priority of HB2313.2013 Virginia Transportation Bill HB2313 | The Moyers Team