12 Contract Strategies to Defeat Competing Contracts

We have been selling homes in an inventory starved market for a few years. A healthy real estate market has 6-months of available inventory for buyers. We are a long way from buyers having an advantage when it comes to purchasing a home as listings are under contract within a few days of hitting the market. Here is solid advice when it comes to buying a home in 2020 and into the foreseeable future:

(1) Be prepared to pay full price.

Make sure recent like homes have sold in the same price range to justify your offer. A fair price in a low inventory market will receive several offers if it appears to be an updated well maintained property.

(2) Be prepared to pay your own closing costs.

The seller is only worried about net profits. Asking for the seller to pay for your closing costs is a guaranteed way to lose in a multiple offer situation. Many will add the closing cost into the contract price if they don’t have the available cash to close.

(3) Consider the purchase of a new home from a builder.

If you purchase a new home without contract contingencies the worry of competing against other offers is gone. You can also get substantial closing cost assistance by using builder affiliates for mortgage and title services.

(4) Be prepared to use an escalation addendum.

This is a way of making an offer at a price you feel is fair to both parties. The escalation clause in a contract allows the buyer to outbid potential competitors by a certain amount, usually no less than $1,000 increments with a cap on the contract price the buyer is willing to offer.

(5) Release the appraisal contingency.

This is the last tactic a buyer should use when trying to have an edge against competing offers. Buyer beware. If the house receives a low appraisal the buyer is responsible for making up the difference between the appraisal amount and the agreed to contract price. The mortgage loan will only cover the amount of the appraisal.

(6) Request a home inspection for information purposes only.

This is a tactic that assures the seller there will be no repairs made if the buyer is happy with the results of the home inspection. If the buyer doesn’t like the home inspection report he can still request repairs. But the seller can immediately release the contract without negotiating the findings of the report and take another offer. We are seeing competing offers which haven’t asked for a home or septic inspection. Like waiving the appraisal contingency this is a buyer beware tactic and we do not recommend it.

(7) Do not require the seller to offer a home warranty.

The average home warranty is $550/year. In a very competitive low inventory market we suggest buyers purchase their own warranty. We provide this free of charge to our clients as a thank you for using our services.

(8) Covering septic and well inspections.

We never think it’s a good idea to forgo a septic inspection (if applicable). Failed drain fields can run $17,000 to $20,000 to remediate. But the average inspection cost is $400 to inspect the complete system. Certainly worth the investment on a house you really want to buy. This is a required inspection by local ordinances when there is a transfer of title. Well inspections are also required by local jurisdictions. Depending on the problem(s), well water repairs can cost thousands. Faulty casings and pumps are the usual problems here. But paying a few hundred dollars for a physical inspection of the well and separate test of the water is worth the investment for a sought-after home. Your agent should have dependable contractors for these inspections.

(9) Pest inspections.

An inspection for wood destroying insects is required in all financed transactions. It is usually a $40 fee for the initial inspection. But it’s also one less requirement of the seller. This doesn’t apply to VA financed deals as the seller is required by VA guidelines to pay for this inspection.

(10) Radon inspections.

A radon inspection is $125 to $150 charge. If you’re trying to find every edge to beat competing offers, agree to pay for this inspection or don’t ask for it as part of your offer. The remediation of a home with high radon levels can be done after the home is purchased. It’s a relatively simple installation process averaging in price from $1,200 to $1,500. Once the system is activated your home is safe.

(11) Down payment and deposit amounts.

A large down payment lessens the worries of a seller. With higher down payments the chances of underwriting concerns lessen with equity in the loan supplied by the buyer. Higher deposit amounts reflect a serious desire by the buyer to close on the home. It’s insurance for the seller to collect if the buyer defaults on the contract.

(12) Closing and contingency dates.

If the seller has a hot property he will know it. The seller will also look for an offer that allows a convenient closing date for the seller’s next destination. This is where your agent communicates with the listing agent to determine the best date for closing. Sometimes this will require the buyer to pay additional rent or mortgage payments of an existing residence. It isn’t a move beneficial to the buyer. But it may be the difference in beating competing offers. Contingency dates for financing and home inspections should be a solution you arrive at after discussions with your agent and lender. If you miss a contingency date on the home inspection addendum, you will be required to proceed under contract without repairs. Therefore, missing your financing date could require the buyer to close the transaction. Failure to do so could result in breach of contract, and possible loss of deposit.

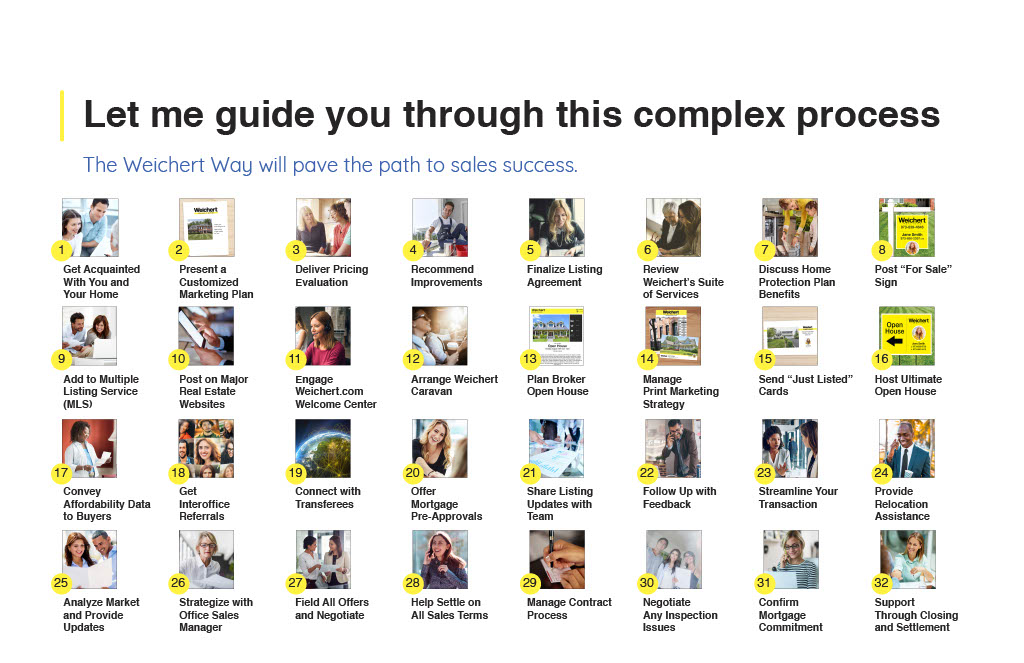

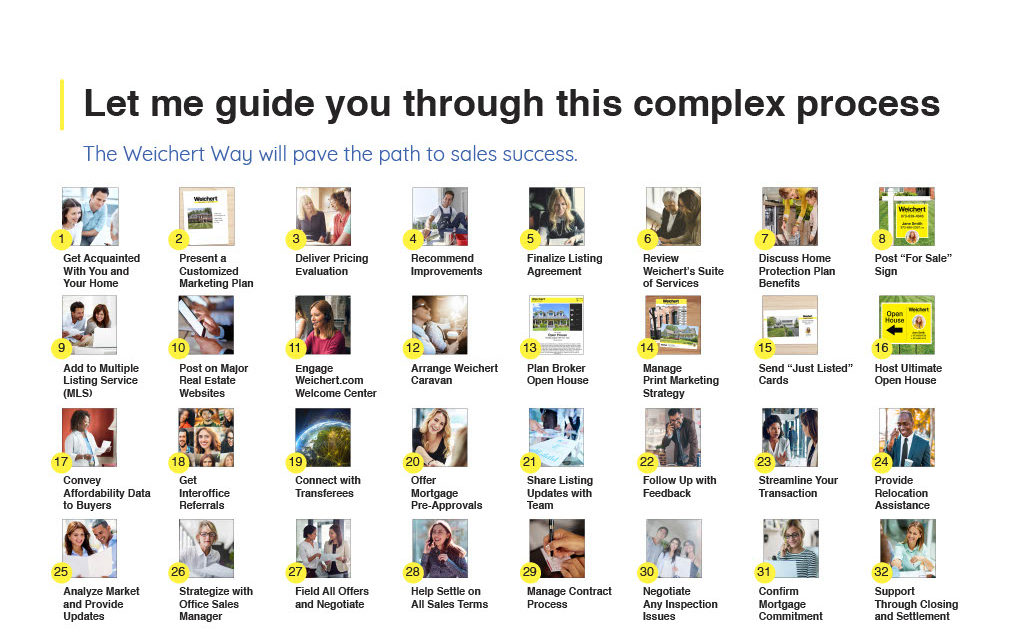

Solution to Defeating Multiple Contract Offers

Lastly, Hire an experienced real estate agent who has successfully negotiated through multi-offer situations. You will need to rely on the knowledge and experience of your agent to advise you on the right moves to buy the right home for you and your family in an inventory starved market. Contact Dwayne Moyers, Weichert Realtors for market statistics, home searches, loan officer and title company suggestions, builder recommendations, and anything else related to real estate in the Northern Virginia/Fredericksburg markets.