Buying New Construction Homes In Northern Virginia

Our real estate careers once involved representing a home builder to manage a real estate brokerage and the sale of new communities in Fredericksburg, King George, Stafford, and Spotsylvania. During that time, Maryanne and I were surprised by the number of people buying new homes without representation of a real estate agent. I also learned most new home buyers entered into contracts without agents for the following reasons:

- New construction buyers often thought they were not allowed to be represented by a real estate agent when buying a new home.

- Buyers often thought if they didn’t use a real estate agent, they would be in a better position to ask for a discounted price on the house.

- Some buyers felt there was no need for representation from a real estate agent when the transaction involved a builder’s contract.

- Many first time buyers believed they were responsible for paying the sales commission associated with having agent representation.

Here are the facts as we saw them while writing builder contracts. Although the cost for marketing and commission payouts are built into the price of the home, it’s not industry practice for builders to discount homes for buyers not using a real estate agent. In most cases, depending on recent sales volume, if you walk through the door of a model home without assistance, the building company may not allow you to be represented by an agent. This occurs because our representation may require the builder to change contract terms, and eliminate fees like lot premiums and transfer taxes. Builders may not enjoy negotiating terms favorable to our clients, but they know it’s against the best interests of the building company not to work with real estate agents, specifically the pool of available buyers we represent.

Creating lower appraisal values on the construction of future homes in a community is one of the biggest reasons builders may resist negotiating lower contract prices. Lowering base prices doesn’t occur often in new home sales. We usually see special promotions when homes aren’t selling fast enough. The most popular builder incentives seem to be half price selections on upgrades at the design studio, free structural upgrades such as basement recreation rooms, decks, morning rooms, and closing cost assistance with the use of the builders lender. Discounts on homes to be built are difficult when the housing market has low inventory and you’re negotiating to buy a home in a popular community. But price reductions on homes purchased from floor plans will occur when sales trends and housing demands change. But negotiating discount prices for new homes depends mostly on timing.

The following circumstances create negotiation advantages and savings for buyers of new homes:

When builders are closing out a subdivision.

The last phase of a new subdivision usually has comparable sales required for appraisals. So builders are less mindful of lowing prices creating problems for future sales. Builders will also discount homes to use sales associates and marketing efforts on other projects. Speeding production and sales (by lowing prices) in a community with a few remaining homes, allows them to focus on new floor plans and features in the latest and most exciting new community. The remaining home sites in smaller projects are usually the worst lots. If you’re still interested after walking the property, it’s time to negotiate some real savings.

Contracts fall apart leaving the builder with completed homes.

Builders are targeting 19% profit margins of the base price on initial contracts. Builders want to avoid getting stuck with a completed home. It’s why purchasing a new home requires a heavy down payment compared to arms-length transactions. Repeatedly paying interest and insurance on finished homes can quickly cause builders to flee a development. If you watch the sales of a new community, you will notice an immediate price slash on completed homes. These are price reductions which lower profit margins to 14% for quick sales. If you really want to live in a new community at rock bottom prices, these are the homes to target for purchase. An example of this recently happened in Potomac Shores (Prince William County) subdivision. A buyer wasn’t able to close on a $735,000 home. The price was reduced to $679,000 upon completion, and later reduced another $20,000 after a month and no contract offers. These offers are great deals if you like the design selections of the buyers who originally defaulted. This is usually due to failure to qualify for financing. Builder contracts will have a financing clause which allows the purchaser to receive a refund of deposits if mortgage rejection occurs for reasons outside the control of the buyer.

Quarterly sales (publicly traded companies) are slow.

This is when incentives are needed to increase sales figures which help meet shareholder and analyst expectations. It’s not hard to figure out which new subdivisions have disappointing sales. During the second week of February 2015, we noticed a national builder was advertising a “Welcome Home Sales Event.” We keep track of sales in this community and they were struggling to sell homes when this marketing idea was used to motivate qualified buyers to consider purchasing a home in this community. The special event offered $10,000 savings and closing cost assistance. Our experience tells us to submit a discounted offer much lower than $10,000 off the sales price (inventory home), and base price and design options on homes built from blueprints. The timing of the “Welcome Home Sales Event” was no doubt due to quarterly reporting approaching fast forcing the building company to liquidate inventory homes to meet sales expectations.

When you see these sales, grab a real estate agent, and have them submit low offers on homes ready for immediate occupancy and homes built from floor plans and design options. An experienced new home sales agent can identify these opportunities to save you money while negotiating with builders. We often demand the removal of lot premiums, adding free finished basement recreation rooms, morning rooms, decks, and other options our clients desire. Building companies will expect you to use an affiliated mortgage company to receive these benefits. It is legal and a common practice in the building industry. If you decide to negotiate lower prices and discounted amenities, there are certain times during the calendar year in the Washington D. C. Metropolitan Area, when negotiations will produce results.

The best months for negotiations are July, August, November, December, January. The Spring market (February-June) is very active for residential sales. The relocation of corporate, government, and military transferees mostly happens during this time. Buyers begin searching in February as we routinely see traffic in new subdivisions begin to increase during the first week of February. Believe it or not, you can predict the timing of increasing interest in new subdivisions to correlate to the weekend after the Super Bowl. It’s been the unwritten rule since we began selling homes.

Buyers come out of hiding during Spring.

The goal of many buyers in the Spring market frequently involves closing and moving to a new home and school district after the completion of the current school year while trying to move into a home before the start of the next school year. In order to buy a new home at a lower price you have to avoid this buying trend. Our experience tells us January 31st and August 31st are the best days to negotiate new home contracts. We negotiated a contract at a new subdivision in Stafford County during the last days of January 2015. Our client had negotiated a contract at $664,000 before contacting us. During our involvement, were able to reduce his purchase price with the same amenities to $611,000. If we had began working on this contract in February, when traffic counts typically increase, our ability to chip away at an agreeable price would have been difficult. Paying the asking price and competing with other buyers for the home site you’ve selected are a common occurrence in new home sales as ski resorts are closing for the year.

In 2015, we purchased a home in Stafford County. Our strategy was to wait until August 31st to get the lot and home we wanted. It had yet to be released for sale and we still pushed for the lowest price we thought was possible. We thought this was possible because new home sales are always flat in the months of July and August leading to negotiating lower home prices before September 1st. We targeted the best lot in the subdivision while refusing to pay the attached $40,000 lot premium. We also asked for 50% all interior design upgrades while using our commission to lower the base price. Our request was initially denied but we stood firm. The builder then asked us to pay what we thought the lot upgrade was worth and we agreed to pay $5,000 toward the $40,000 lot premium and we ratified a deal. With this timing we were able to load our home with upgrades while paying well below the appraisal value.

New Homes Real Estate Agent Maryanne Moyers

Maryanne Moyers discusses floor plans, structural and design options, and the difference in new home communities in Woodbridge, Virginia.

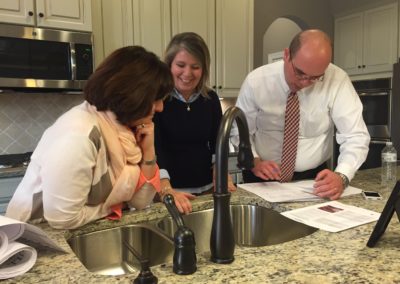

Associate Broker Maryanne Moyers Showing Richmond American Homes

Maryanne Moyers working with a client and explaining the difference between production built homes, custom construction, and the building and contracting process with modular homes.

A Successful Closing with Beazer Homes

The conclusion of the new home buying process. A successful closing with Beazer Homes. We sold the existing homes of this couple and found a great house for them to enjoy together.

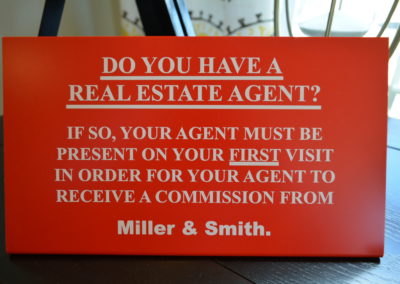

Using Real Estate Agents When Buying New Homes

Builders pay commission fees for us to represent you. But it’s a good idea to have us with you during the home search tour in order to register us as your representative during the buying process.

Problems with Building New Homes

This is an example of poor execution during the construction process. The construction coordinator ignored the weather forecast resulting in completely soaked floors and standing water in the basement. An earlier start on framing would have allowed the construction of a roof with a protective layer shielding the building materials from the possibility of damage. The amount of building debris and trash indicates the subcontractors are not under direct supervision of representatives of the building company.

Structural and Design Upgrades in New Homes

Weichert Realtors Associate Broker Maryanne Moyers is shown here working with a client and Ryan Homes sales representative Cameron Walker signing a contract addendum after an agreement was finalized on interior upgrades.

The New Home Walk-Through Inspection

Maryanne Moyers helps clients during an initial walk-through of a newly constructed home. Dwayne and Maryanne attend all inspections and meetings with their clients. We are able to identify industry standards in workmanship. and unacceptable work and negotiate corrections before closing.

The Construction Meeting Before Building A New Home

This is construction meeting between our client and representatives (construction coordinator and sales manager) of Ryan Homes at Lake Estates in Stafford County.

Negotiating Pricing for New Homes

This picture illustrates the process of selecting structural upgrades and price negotiations between Maryanne Moyers (right) and Ryan Homes sales representative Lauren Keeler.

Finding Deals in New Home Communities

This is the Berkeley home design at Potomac Shores. When the buyer did not meet financing obligations, this home was discounted $66,000 and available for prospective buyers waiting for a bargain in this community. Contact us to watch this community and work with you when these opportunities arrive.

Reasons for hiring a real estate agent when purchasing a new home:

Builder Reputation.

Nobody knows the craftsmanship and dependability of a builder better than a real estate agent. Here’s why. Typically, experienced real estate agents have sold an individual builder’s product several times, and it’s common for an experienced agent to sell the same house twice. This allows experienced agents to examine how well the product of a builder survives the warranty period and beyond. An agent representing a home buyer can share the insight from scores of homeowners who have explained how well they were treated by the builder while the warranty period required repairs to be addressed by customer service crews employed by the builder. An agent working for the buyer can also provide a timeline of any habitual problems that occur in a home built by known builders in a given area.

Experience Counts.

Experienced new home real estate agents will agree when you are buying new homes the most important addendum in a builder’s contract is the standard features page. It is the contract page which describes and guarantees the minimum quality of materials in the completion of your new home. Some builders will complete a contract package without having standard features and materials written into the contract and agreed by signatures. Under no circumstances should you have a home built until there is a legal agreement signed describing the material used by all tradesmen who work on your home. In Virginia, courts presiding over real estate matters will not recognize any agreement unless it is in writing. While agreeing to have a builder complete your next home, if it’s not in writing you probably won’t see it in your home.

Verbal agreements, and seller handshakes with a verbal promise are meaningless, and should be avoided 100% of the time. Professional building companies know better than conducting business with a slap on the back accompanied by a promise. If it occurs during contract negotiations it’s a meaningless gesture. After signing a contract on a home, there are several inspections that should be available to the future homeowner, and their agent. These inspections will insure the standard features (including upgrades) have been installed as agreed upon by contract.

Industry Inspections.

An experienced new construction agent will advise you not to sign a contract when you are buying new homes without written agreements to document the inspections which you are permitted to make during certain points in the building process. Standards in the building industry should allow a home-to-be-built purchaser to have detailed floor plans and site plans inspected and initialed as part of the contract package. Industry standards allow the following inspections:

- Site inspection (including the approval of house location).

- Framing inspection.

- Wiring inspections before drywall for approval of outlets, media wiring, and special agreements.

- Mechanical and trade inspections.

- Initial and final walk-through inspections.

We accompanied our clients during a framing inspection and found problems with workmanship and building materials. We worked with the project manager to have these issues corrected before the next phase of construction covered the problems.

The opportunity to use change orders to add structural and design options has a specific schedule. If we represent your interests during the construction of your new home, we will inform you of approaching deadlines as you spend time planning the sale of your current home and the planning and execution of your move. If you give us enough lead time, we can negotiate change orders. But waiting until the framing inspection is usually too late. The inspection process is another reason for utilizing a real estate agent with a background in the building industry. Our experience has taught us acceptable and unacceptable finishing standards.

As shown in the above slide show, we’re not shy about the use of blue tape during a walk-through inspection. If you are not working with a real estate agent while buying a new home, we recommend hiring a home inspector with contracting experience to examine the workmanship of your home. The local jurisdiction where your home is built will conduct several coordinated inspections with the site superintendent after all building permits are issued. These inspections are only to satisfy building code requirements. They often do not address craftsmanship standards.

This is an inspection of electrical drops and special wiring and lighting arrangements before drywall closes off access to add or correct electrical work. This photograph shows our client and representatives of Ryan Homes at Lake Estates subdivision (Stafford County) verifying that special requests for electrical work have been completed before drywall work begins.

Financing.

When buying new homes, an experienced agent will have a reliable network of lenders with various loan programs which best meet their clients needs. Larger builders will require purchasers to initially qualify with preferred lenders (which the builder has part or complete ownership) who are trying to capture your business. This is an acceptable practice by the builder as he determines if a potential buyer is credit worthy enough to enter into an agreement. But it is a violation of federal housing laws to require a home buyer to use only a preferred lender without allowing other financing options.

There are often incentives given by the builder for using a preferred lender such as closing cost assistance and/or upgrade options for financing the home. But buyer beware. There are often hidden fees with many builder’s lenders, as well as points associated with these loans. In many cases the loan option by the preferred lender is offered at a higher rate. This helps the builder recover the cost of providing options at no cost in exchange for using a preferred lender. This is when your agent reviews your financing package, and has their network of accomplished lenders attempt to find a financing program which provides greater financial benefit.

Appraisal process.

Often the representatives of the building company will communicate with the appraiser assigned by the mortgage company handling the home loan. This is done at the request of the appraiser to use transactions inside the subdivision as comparison properties to find value at the contract price of the subject home. When you are buying new homes, if the contract price is higher than the appraisal results, the buyer will usually be required by builder contract to pay for the difference at the closing table. This is usually an impossible task for most purchasers since the required down payment made when entering into a contract usually drains most of a typical buyers available funds.

We have often communicated with lenders on behalf of many clients who were caught in this trap by searching and finding a second set of properties to use for comparison pricing which are not in the same new home subdivision. When you are buying a new home, if you feel you can negotiate a deal with a builder without an agent you will most likely fail. Building companies cannot conduct business in a subdivision by habitually negotiating lower sales prices. If this occurs the builder will have caused a downward trend in pricing, and future homes will not appraise for target values by the builder. It also lays the groundwork for upsetting previous buyers. Many who will voice displeasure for paying more for the same home. A reputation builders want to avoid as a habitual business practice. But sales directors and regional managers of building companies do understand discounted contracts accompanied with agent representation also have clients who are considering all homes in the surrounding area, and not just homes in new subdivisions. If sales expectations are not meeting goals and the number of potential buyers working with sales managers is low, offering less than the asking price with an agent at your side is another pressure for new home sales representatives. This simple concept should convince you there are no advantages to walking into a model home without a real estate agent.

Closing.

It’s helpful to have the eyes of an experienced agent to review settlement charges when buying new homes. Before our clients go to closing we review all financial documents to make sure it outlines the good faith estimate. Real estate agents representing buyers will maintain contact with lenders and settlement agents to make sure all necessary documents for a completed loan package are forwarded to the settlement company for timely closings. We maintain communication with the building company transaction coordinator to make sure all change order requirements, contract agreements, county inspections, and financial deadlines and commitments are met and finalized.

The Cost Breakdown of Building a New Home

On November 2, 2015, the National Association of Homebuilders published Costs of Constructing a Home. According to this article, the breakdown of expenses require 62% for construction costs, and the finished lot costs are 18.2% for a single-family home with a $468,318 sales price (national average) on a one-half acre home site (national average). The breakdown of expenses are listed below:

- Interior finishes: 29.6%

- Framing: 18%

- Exterior finishes: 15%

- Major systems rough-ins: 13.1%

- Foundations: 11.6%

- Final steps: 6.8%

- Site work: 5.6%

- Miscellaneous costs: 0.5%

Our New Home Sales Experience: We have represented past clients during the new home purchase process with Atlantic Builders, Augustine Homes, Beazer Homes, Brookfield Residential, Centex Homes, Del Webb Communities, Drees Homes, D. R. Horton, Hazel Homes, Hylton Group, K. Hovnanian, Lennar, M/I Homes, NVHomes, Pulte Homes, Richmond American Homes, Ryan Homes, Ryland Homes, Sona Homes, Stanley Martin Homes, Toll Brothers, Tricord Homes, Van Metre, and Winchester Homes.

There is a method to negotiating a final sales price for a new home. Our goal is to save you money. Have us represent you and that’s what we’ll do. Contact us for details.

Need Help Selling Your Home?

If you would like a FREE comparative market analysis, complete this form and we will give you our analysis of the current market value of your home.