We continue to learn of problems experienced by the purchasers of new homes during the construction, walk-through, and closing phases. Writing the contract with the builder’s sales representative never seems to be a problem with consumers. When buying new homes from builders these problems usually occur after contract agreement including financing options, and post-closing repair agreements. This article will also address the demands of the builder to move the closing date to an earlier date than listed in the written agreement.

Why closing date changes occur usually depends on the builder you sign a contract with to deliver a new home. While representing new home purchasers in the past, we have dealt with the sales managers of nationally recognized builders informing us of changing closing dates because the home was ready for delivery earlier than expected, and the sale would help meet corporate sales projections.

View this practice as an investor holding common stock of a building company. Most of the larger builders are publicly traded companies with listings on the NYSE & NASDAQ Stock Exchanges. These listings need them to have public quarterly earnings reports which are closely followed by shareholders during conference calls. It might be necessary for builders to move closings dates to report sales figures which meet shareholder expectations. After representing a building company we learned this practice is not unusual, and pushing a closing date forward is addressed in most builder’s contracts.

It doesn’t matter if you’re purchasing a home from a builder trading shares on a public stock exchange, or a smaller builder using alternative financing to deliver completed homes. In either case be aware that changing closing dates will be among many things you can’t change simply because it suits your timeline of moving from your current home.

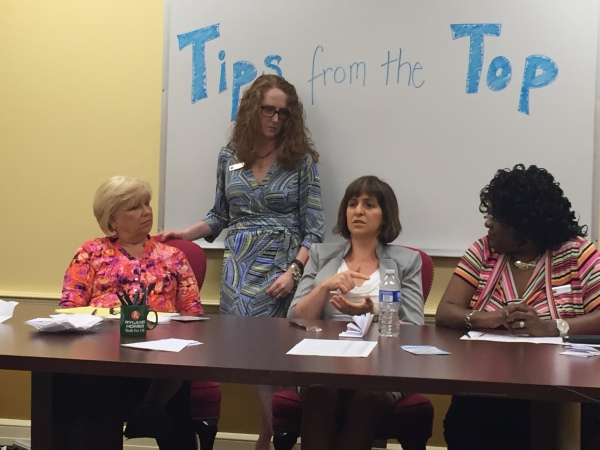

Like every profession, some real estate agents are better than others. When searching for an agent to represent your interests in the biggest investment of your life, seek out experienced full-time agents. Maryanne Moyers has a wealth of experience in all facets of residential real estate in both new home and arms-length transactions . Her knowledge is often sought by other Realtors working through problem transactions. Maryanne is shown here in an office forum providing her opinion on questions submitted by other agents.

On the business side of a builder contract, if quarterly sales are not meeting early reporting projections, the builder can increase revenues by moving the closing dates on homes ready for delivery. It can be that simple, and the builder is perfectly within legal rights and obligations to do it because you signed the contract agreeing to let it happen. In simple terms, your closing date changed because increased closings mean increased revenue reports, leading to higher earnings, better stock valuations, and satisfied shareholders.

Regional and local builders usually receive funding from investment groups or smaller banking firms. In order to comply with financing terms for subdivisions or smaller projects, these builders must often show the continued ability to complete and sell homes in a timely manner to receive future financing. Closing dates with smaller builders may also change for the buyer depending on the structure of a financing agreement between the builder and lending institution. This usually occurs to avoid increasing monthly interest payments on the construction loan. We’ve seen this while representing both sides of a builder’s contract.

We would like to emphasize how important it is to be represented by a Realtor when buying a new home. It is common practice for new home customers to try negotiating with builders for a discount because they are not represented by a real estate agent, and there isn’t a commission cost to the builder. After selling homes for builders we can tell you this strategy will not produce a discount on the price of your new home. Builders cannot cut the price of a home without it reducing the price of remaining homes to be built in the same subdivision. If the builder reduces the price of your home, the appraisal value for comparable homes will also drop. Therefore, no real estate agent = no discount.

It’s important to remember a builder’s contract favors the builder. It’s written by a real estate attorney hired as legal counsel by the builder to avoid as many legal issues as possible without violating fair housing standards. It is NOT a regional purchase agreement used by licensed real estate agents intended to protect all parties.

There are several agreements in a builder’s contract which can be viewed as unfair but are legal business practices. Buying new homes from builders without representation can cause buyers to sign agreements without having both sides of the contract discussed in detail by the builder’s sales representatives. It’s important to remember, when you walk into a model home, the person you meet is under no obligation to care for your best interests. They are the builder’s employee, and represent only the seller’s interests.

If you have signed a contract with a builder, and you are required to change the closing date, chances are (without examining the contract) you are bound by contract terms to move the closing date forward if your loan package is ready for closing. If you are informed the home will not be ready for delivery, and your closing date has been delayed, the same rules apply. All contracts we have examined in the past have language which anticipates financing problems, and have a kick-out date if proper financing is not obtained by the performance date. Delayed closings caused by the builder for causes related to delivery of the home are presented as reasonable in many cases, and must be accepted without penalty by the purchaser.

Conversely, these agreements have also anticipated purchasers receiving approved financing ahead of schedule. In these situations expect the contract to include written instructions requiring the buyer to take ownership of the house as early as possible. The builder might also demand an early closing for no other reason than simply getting rid of the liability of holding a vacant house.

There are many issues we could discuss about the risk of buying new homes from builders. But that’s for other articles. If you’re considering the purchase of a new home be smart about it. Find an experienced Realtor with a background in negotiating builder contracts. The cost of an agent commission are built into the offering price by the builder, and walking into a model home without an agent does not give you a bargaining point. You will not receive a discount through the builder by purchasing a home on your own without an agent. But you will be on your own through the purchase process. With the builder paying your agent to represent you it is an unnecessary risk to move forward without representation from an experienced new home sales agent. If you’re considering the purchase of a new home in Northern Virginia consult us before making your first move.